In 2018 the number of new seller financed notes created increased by 2% while the dollar volume of residential notes was up nearly 20% over 2017.

Overall there were 91,605 first position owner financed notes, totaling $25.9 billion.

The average Loan-to-Value for newly created residential notes was 81% LTV, with commercial at 75% LTV, and land at 74% LTV.

“We have seen a definite increase in the notes created since last fall. My customers have reported more sellers are responding than typical for late spring and summer.

Residential loan volume is up nearly 20% over 2017. It appears that increases in conventional mortgage rates last fall may have triggered more seller carry notes.” comments Scott Arpan of Advanced Seller Data Services.

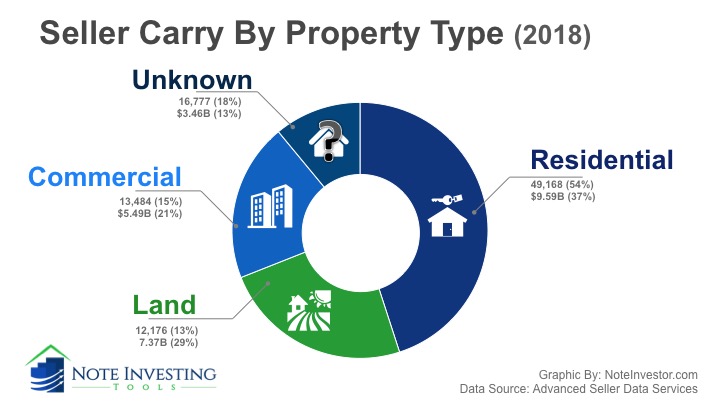

5 Key Seller Carry Statistics For 2018

- $9.59 billion in seller financed notes were created on residential properties compared to $7.9 billion in 2017. While commercial and land had a much lower number of transactions, the dollar volume was still sizeable at $5.49 billion and $7.37 billion respectively (with the balance being an unknown property type).

- The average loan size for residential seller carry-backs increased 5.4% over 2017, from $184,992 to $195,062.

- Texas, Florida, California and Arizona remained the top 4 states for usage of seller financing (based on count).

- The top ten states created nearly 69% of all seller financed loans for the year.

- The number of multi-note creators was on the rise – 82% of sellers carried one note, while 7% carried 2-3 notes, and 11% carried 4 or more (in a 12 month period).

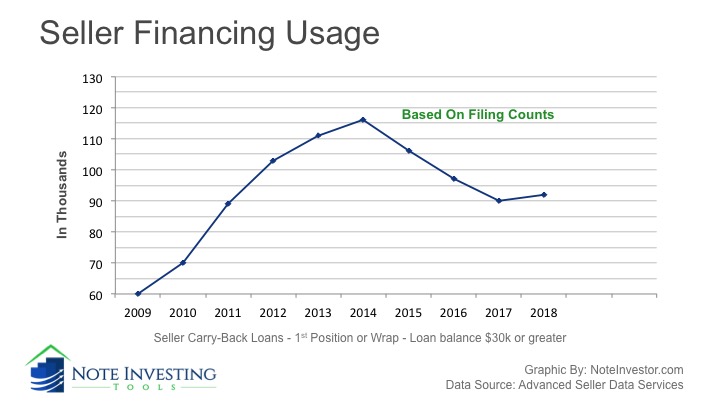

The Seller Financing Cycle

The installment sale has been around for decades and is a common choice for properties or buyers that have challenges qualifying for traditional bank loans. Seller financing most recently grew in popularity after the subprime meltdown and then started to decline in usage after 2014 as conventional lending stabilized.

Now many real estate investors are starting to incorporate seller financing into their buy/sell models contributing to the increases in 2018.

Usage of Seller Financing From 2010 to 2018

| Year | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Count | 70,159 | 89,439 | 103,313 | 110,979 | 116,178 | 105,871 | 97,089 | 89,779 | 91,605 |

| Change | +27.5% | +15.5% | +7.4% | +4.7% | -8.9% | -8.3% | -7.5% | +2% |

Number Of Notes Created by Property Type

The number of notes created by property type (from records where property type is known).

| 2015 | % | 2016 | % | 2017 | % | 2018 | % | |

| Residential | 56,881 | 54% | 47,651 | 49% | 42,916 | 48% | 49,169 | 54% |

| Commercial | 14,841 | 14% | 14,467 | 15% | 13,930 | 16% | 13,484 | 15% |

| Land | 12,215 | 12% | 11,784 | 12% | 13,417 | 15% | 12,176 | 13% |

| Unknown | 21,934 | 21% | 23,187 | 24% | 19,516 | 22% | 16,777 | 18% |

| 105,871 | 97,089 | 89,779 | 91,605 |

Top 10 States For Seller Financed Notes In 2018

The Top 10 states for the creation of seller financed notes made up 68.91% of the overall volume.

| State | 2018 Count | Percentage |

| Texas | 20,768 | 22.67% |

| Florida | 9,540 | 10.41% |

| California | 9,393 | 10.25% |

| Arizona | 4,364 | 4.76% |

| North Carolina | 4,157 | 4.54% |

| Georgia | 4,036 | 4.41% |

| Washington | 3,814 | 4.16% |

| Oregon | 2,541 | 2.77% |

| New York | 2,395 | 2.61% |

| Pennsylvania | 2,126 | 2.32% |

| Top 10 | 63,134 | 68.91% |

| All 50 States | 91,605 |

Single Note Creators Vs. Multi Note Creators

The number of sellers creating multiple notes in 12 months has increased. One contributing factor could be an improved understanding of the Dodd Frank Act including RMLOs willing to assist with the disclosures, documentation, and ability to repay qualifications.

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| Seller Created 1 Note* | 102,227

88% |

90,078

85% |

78,616

81% |

76,675

85% |

75,116

82% |

| Notes From Sellers Creating More Than 1 Note* | 13,951 | 15,793 | 18,473 | 13,104 | 16,489 |

| Totals | 116,178 | 105,871 | 97,089 | 89,779 | 91,605 |

These 2018 statistics were provided by Advanced Seller Data Services, a mailing list provider for note investors and brokers. Stats are based on 2137 counties reporting, $30,000 or greater balance, and 1st position or wrap/AITD notes.

What are your thoughts on the recent statistics? We’d love to hear your feedback in the comment section below this article.

As a buyer where can I find a very good template to draw up a document requesting seller finance win win terms.

Hello Tracy,

Thank you for an excellent informative thorough presentation on data from the Note Industry.

All the Best!!!!!

Michael F. Morrison

You are welcome Michael!

Awesome article Tracy. Exciting! Thank you.

Hello Alex, You are welcome and glad you enjoyed.