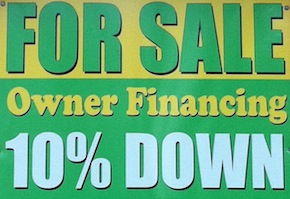

This month’s owner financing real deal comes from our email inbox. Chances are this simultaneous closing question has been on your mind too.

This month’s owner financing real deal comes from our email inbox. Chances are this simultaneous closing question has been on your mind too.

Question: I’m a rehabber in Florida and would like to have a company to work with that helps me qualify buyers, structure notes and then buy the notes from me as an exit plan for my rehab properties, either at closing or shortly after. Are you doing or know of anybody doing simultaneous closings anymore? If not, after how many payments will you buy on a “green” note?

Response: You ask a great question pertaining to the simultaneous or simo closing. There has been a shift in the marketplace and most investors are avoiding the true simultaneous closing due to three primary reasons:

1) Dry-up of subprime securitization funds on the secondary market

2) Tightening underwriting standards due to increased foreclosures and decreased values

3) Regulatory concerns that a simultaneous purchase might be construed as a loan (especially in light of recent developments like the HUD Safe Act, HR 4173, and the Dodd-Frank Act)

The closest thing is what some investors call a “near simo” where an investor buys after closing once the deal is recorded and the first payment has been remitted to the seller. Many investors are also limiting their exposure on new or green notes to a partial purchase at a 50-60% ITV until the payer has a proven payment history.

This reader already had a good foundation of knowledge with access to the structuring tips contained in Finding Cash Flow Notes to help create mortgage notes that are marketable to an investor. If any of the terms are new, here’s a quick overview:

Green Note – a new note without a proven payment history.

Seasoning – the number of payments that have been made on a note.

Simultaneous Closing – The property is sold to the buyer, a seller financed note created, and the note assigned and sold to an investor, all through the same closing.

Near Simo – The property sale is closed and the documents recorded in the county records. The investor purchases the seller carry back after a certain amount of time has passed (generally ranges from 3 to 30 days and varies by investor). Note buyers may also require proof the first payment was made to the seller.

We are the only charity that accepts mortgage donations of worthless mortgages. The website link will give you some details.

Consider this mortgage:

junior position

over 1 year no payments

property upside down

First mortgage is more than FMV

Rumors of foreclosure are circulating

We’ll Take It!

The benefit to the owner is both cash to them and better timing than a write off as a bad debt.

INTERRUPTION… what happened?.. something kicked me out so this is a continuation and I hope conclusion of PASSIVE ACCEPTANCE…

…. The Savings and LoanSca ndal … Caused by the Govt raised the FDIC insurance from $10,000 deposit to $100,000 deposit … without any other measures..inflated the real estate constrnuciton business … then surprise …

..oversupply…overbuiding ..market crash ..and who do they go after ..? not the zillionares who scammed millions ..no they go after the real estate agents.. loan agents and appraisers…more regulation..more licensing .. the water gets hotter.. but we dont n otice… oh… sorry.. on a rant again… this is not the place for such a long ramble… but now …PLEASE.. do you get the idea yet??

The Govt in all its bureaus.. are making these laws WITHOUT any constitutional

authority or moral authority… and we accept them with barely a murmer..

Dont you think its time …long past .. to take the battle to them… dont we have some lobbying organisations..? that arent in the pocket of Govt.. Im afraid NAR

and many of our so called lobbying groups are Govt controlled… theyn are mere shills who collect our dues…like the un ions.. but take the Govt side.. Is there anybody reading this who understands…? is there anybody who has the power and the desire to help… ? to fight these Govt actions… regulations.. etc… that come like clockwork after each boombust cycle..? Hello ? anybody there? Help

I think you were cut off since your question/comment was so long. In any case, you are right, we certainly need some accountability in Washington (it hasn’t been there for a very long time!).

I have been in the business for 30 years and have gone thru about three of

these boom..crash… burn cycles… now Im in my mid 60s..

The thing that bothers me the most as I read various industry posts is

the sheer PASSIVE ACCEPTANCE of the increasing regulation forced

on us after each cycle…

Folks … dont you have any sense of the WRONG… that all these restictions and regulations represent..?

Think about this: Two adult parties enter into a lawful contract to buy and sell …

another party lawfully agrees to buy.. a note &D.O.T. … Now.. under any construct of free enterprise …WHY should the Government be resticting …

….anything… ? But all I see is PASSIVE ACCEPTANCE of these regulations that have no basis in law or equity or especially the Constitution..This disturbs me most of all… Id like to hear from y’all , have you ever thought about it…?

Y’ all are like the frog in the kettle…its getting worse and worse but you accept it.

WITHOUT PROTEST. There must be some lobbying organization on OUR SIDE

that has the resources to fight these regs..

Listent… these regs are just BOGUS atttempts..by legislators to find a SCAPEGOAT.. and the scapegoat is always the low man on the totem pole.

The Government creates these ridiculous laws..( 120%LTV, liar loans, etc) for political gain… for votes.. for donations.. but they create these laws… either knowing or ignorant of the boom and bust they create.. but without concern… for the consequences.. they create the policies and laws and regs that cause the fraud and abuse.. but they do it so they get the votes from the “underprivileged..”. among us… thats code.. you figure it out.. But this goes on and on in cycles of about 10 to 15 years.. from WWI and the resultant inflationboom roaring 20s to the requisite crash and dpresseion of the 30s to the boom years of the WWII era the 40s-50-s 60-s to the resultant inflation of the 70s and 80s … to the Savings and Loan scandal… Govt

T

Buying BRAND New unproven “paper” is RISKY….but it can be done if the structure of the deal makes common sense.

We recently were involved in a builder selling his expensive Jacksonville, FL home which had been lingering on the market for $450K. The buyer was putting down $325K…yes that’s $325,000.00 CASH. This self employed buyer with decent credit scores could not obtain any type of financing at a decent interest rate even with that large down payment.

The builder did not want to lose this sale so he took back a $125K 1st lien Mortgage & Note , they closed the deal, recorded the documents, and then 1 payment was paid approx. 3 weeks later. We then took the seller financed “paper” off the builders hands.

With new or newer seller financed “paper” the emphasis should be on EQUITY and CREDIT… a strong credit buyer and where some equity is being established via their down payment and commitment to the property.

Best to your success,

Michael Morrongiello

http://www.sunvestinc.com

# 707.939.9450

I always read the article sent in my mail box.

U guys do a great job.

Very informative stuff.

Manu

goforshortsale.com

347-753-0400