We just returned from the NoteWorthy convention where everyone seemed to be talking about three things:

1. The increase of owner financed notes (up by over 15% in 2012);

1. The increase of owner financed notes (up by over 15% in 2012);

2. The opportunities in non-performing notes; and

3. How to effectively market a note business online.

It was great to connect with old friends and meet new ones at the event. Here are a few highlights we wanted to share…

Seller Financing on The Rise for 2012

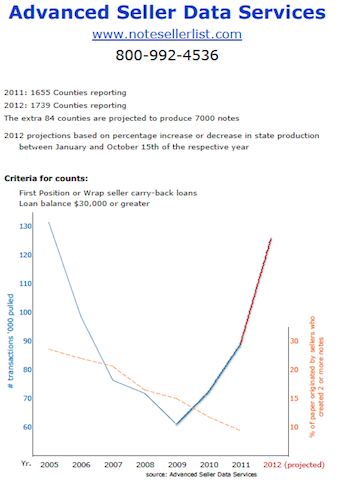

- Note creation is up 31.7% from 2011 to 2012 when comparing the same counties and time period data available (Year to Date through Oct 15th).*

- Note creation is up 57.7% from 2009 to 2012 when comparing the same counties and time period data available.

- Over 90% of seller carry-back notes are now created by sellers who create only one note.

Editor’s Note: Updated and adjusted statistics for 2012 reflected the year ending at a 15% increase – read details here.

These revealing note business statistics are broken down State by State for reporting counties using loan balances of $30,000 or greater on first position or wrap-around seller carry-back notes. Scott Arpan of Advanced Seller Data Services was kind enough to compile and share this information.

The screen shot might be a little hard to read so the PDF is available for download by clicking here. If you decide to share this research please be sure to credit back to Scott at NoteSellerList.com. He can be reached online or by phone at 800-992-4536.

REO Investors Turn to Non-Performing Notes for Inventory

Non-performing or delinquent paper from banks continues to be a hot market – and its not just note buyers paying attention.

With REO inventory tightening and competing bids increasing many investors are looking to fill their appetite by controlling the note. The holder can then negotiate with the payer to get the note re-performing, accept a deed in lieu, or proceed with foreclosure to take back the property. This “perfect storm” was the focus of the State of the Note Industry presentation.

Note Buyers and Brokers Have Embraced Online Marketing

Websites, social media, and online marketing are everywhere and real estate notes are not immune. We detailed the online marketing portion extensively during our presentations at the event, but in case you missed it we have you covered with these resources:

7 Essential Tips For Marketing Your Note Business Online

Finding Cash Flow Notes Training

Building a Winning Cash Flow Business Website Video

Does anyone have access to statistics concerning how long typical note holders generally hold their notes? In other words I am looking for the peak time periods to concentrate on to choose lead lists and direct prospecting. So, for example, the peaks of holding periods could be 6 months, 2 years, 5 years, 9 years, 14 years and 18 years, or some completely different numbers. I got an answer on this years ago but can’t find it and that’s fine because some fresh data would be better. If anyone can help with this it would be greatly appreciated.

UP 30%??? That good to know and great to hear!!

I knew that the SAFE Act wasn’t going to impede determined private lenders. I will be sharing this great news in my other circles.

We are a resilient group – plus it fills a real need in the real estate financing market today!