There is a lot of talk lately about inflation. But what about inflation and note investing?

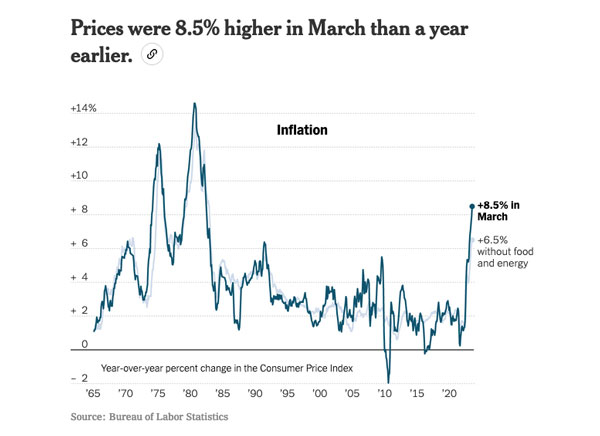

It stands to reason inflation has people worried after we kicked off January and February 2022 with some unusually high numbers (7.5% and 7.9% respectively) — or so we thought.

Then March and April were even higher at 8.5% and 8.3% respectively.

NOTE: Keep in mind those are TRAILING 12-month periods (not a month over month). Source: US Inflation Calculator

Inflation and Note Investing – Should We Be Concerned?

We should not ignore inflation but use it as an opportunity to ‘check-in’ with our overall investment and wealth-growing strategies.

If we are buying our real estate notes at a fair market price, we should be staying ahead of inflation… but there are a few things to keep an eye on.

First off, let’s look at the history of inflation.

Log onto social media and ‘the end is near’ comments will pop up left and right. The fact is, we have been here before, particularly after a hard fall.

The economy handles a hard fall much differently than growing quickly – and there is a BIG difference between growing quickly and REBOUNDING. After two solid COVID-19 year, we are experiencing the later.

Tie that to supply chain issues as everyone gets back up to speed and we have a very unique (and rare) problem.

This Gives Us TWO Primary Types of Inflation Working at the Same Time…

Demand-Pull Inflation

Where demand for goods exceeds production capacity.

and

Cost-Push Inflation

Where increase in production costs push price increases.

These two together are a vicious yin and yang that just feed each other until one gets tired.

In looking at history, this is not the highest point we have hit — not even close. In the seventies we were over double digits, on two different years (’74 and ’79). In 1980 we were a whopping 13.5%! AND THOSE WERE THE ANNUAL PERCENTAGES.

Yes, the 2022 has started high but we have a long way to go for an annual average that causes note investor alarms to go off (2021 finished at 4.7% with three months over 6%).

Impact of Inflation and Mortgage Rates

The most obvious impact of inflation are increased prices. Just walk into a grocery store or fill up your gas tank and you feel the hit. The decreased purchasing power of a dollar means people have to get by with less or make more.

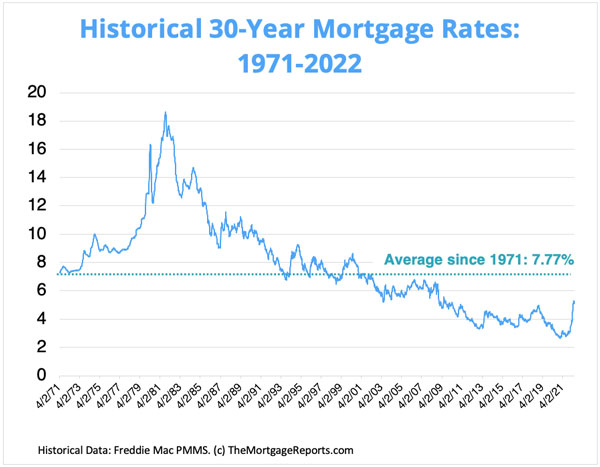

To curb inflation the government increases the federal funds rate to shrink the supply of money available. This leads to increased borrowing costs, including the average rate of a 30-year home mortgage.

These historical charts reflect the correlation between inflation and mortgage rates.

But What About My Investments in Real Estate Notes?

There are couple BIG advantages to notes.

For starters, you probably didn’t invest in a note earning 3%, 4%, or even 6%. Odds are, your investment calculates a return in the double digits (with most people in the 10% – 14% range.)

But let’s say you are ONLY getting a 7% return, You would have beaten (and usually doubled) inflation every year FOR THE LAST 40 YEARS!

A secondary benefit of note investing? When inflation rolls around, note investing offers the protection we have ‘created’ with regards to the potential value of properties decreasing.

As note investors, we set our ITV (Investment to Value), often minimizing our exposure in the form of a partial. This gives us far more breathing room if values decline.

7 Ways Note Investors Can Protect Against Inflation

- Use Tax Advantaged Accounts Whenever Possible – Saving money on taxes increases the long-term compounding effects of your investment.

- Target Yields That Surpass Inflation – Look beyond the face rate of the note and use IRR (Internal Rate of Return) to calculate your true yield net of costs over time.

- Flip Notes If Uncertain – You can always opt to refer a note for immediate income if you are worried about long term holding risk.

- Consider Shorter Terms – If you are worried a 10% IRR won’t be enough in 15 or 20 years then consider notes with shorter terms or purchasing a partial.

- Play on House Money – Get whole by selling a partial that recoups your investment and keeps payments in the future. An infinite return always beats inflation.

- Lock in Lower Rates Wherever Possible – If you are hypothecating or borrowing against notes it makes sense to lock-in at lower rates. Or if you have lower face rate notes, you might want to sell a portion of your portfolio if concerned rates will continue to increase.

- Control A Lot with A Little – Combine knowledge of the Time Value of Money with similar concepts including: Options on Real Estate, Wrap Around Notes, and Subject to or Sub2 Transactions.

You also want to keep a watchful eye on:

- Idle Cash

- Recession Risk

- ITV Risk

- Higher Risk Assets

- Declining Values

Yes, note investors need to be aware of inflation but it not necessary to panic. With the right management, real estate notes can continue to help investors build wealth and hedge against inflation