What’s old is new again and the credit crisis, struggling economy, and real estate market are making seller financing the come back kid.

What’s old is new again and the credit crisis, struggling economy, and real estate market are making seller financing the come back kid.

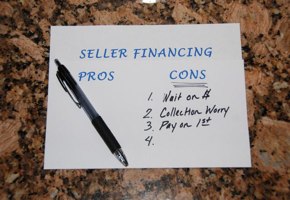

Offering to owner finance a property can attract buyers and even save transactions as banks increasingly stamp “DECLINED” on mortgage applications. Before you agree to “Be the Bank” carefully consider the downside to providing creative financing.

Time is Money – For most sellers waiting to get paid is the biggest drawback since they would prefer to receive the full purchase price in cash at closing. Using a balloon payment to shorten the term of repayment can often reduce the severity of this time delay. Using temporary seller financing techniques can also help optimize a subsequent sale of the payments to a note investor.

Honey, Did You See That Check? – It will take time every month to keep track of the payments. An amortization schedule helps to accurately calculate the interest, principal, and remaining balance due. There are also annual 1098 mortgage interest statements to prepare. Many sellers decide to leave all this to a professional and make use of an outside servicer.

Here Comes Guido – When payments don’t arrive on time sellers will quickly find they have been cast in the role of bill collector. They also have to worry about if the buyer maintains the property, lets the property insurance lapse, fails to keeps the real estate taxes current, or violates any other terms of the financing arrangement.

No TARP for You! – There is the risk a seller will need to initiate foreclosure proceedings if the buyer fails to make payments (or follow any other terms of the note). Along with time and money, in today’s market foreclosure comes with the risk a property might be worth less than the outstanding balance due. There is no government TARP lender bailout plan for the individual seller!

Who’s On First? – When a property is sold with owner financing and the seller still owes money both the buyer and seller need to be concerned about timely repayment of the underlying lien. The first position might also have the right to accelerate their mortgage under some type of due on sale clause. Most note investors will pay off the seller’s underlying liens out of proceeds when they purchase the future payments. (Read more at Wraparounds with Underlying Liens)

They Offered How Much?! – If a seller gets tired of the monthly payments trickling in they can sell the note to an investor for cash now. While future payments can be sold to a note buyer it is usually at a discount rather than full face value. How steep of a discount depends on the equity, interest rate, payer credit, property type, and other terms. (Read more at Structuring Notes for Top Dollar Pricing)

Of course it’s not all bad. Many buyers and sellers use owner financing to create a winning solution for both sides. The trick is to work with qualified professionals that can steer you in the right direction. To discover the positive side of seller financing be sure to read 10 Advantages to Using the Seller Carry Back.

[…] The Downside of Owner Financing – Disadvantages to Seller Financing […]