The word is out and seller financing is on the rise as buyers and sellers look for creative ways to finance property in the struggling market.

The word is out and seller financing is on the rise as buyers and sellers look for creative ways to finance property in the struggling market.

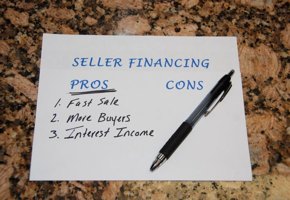

So what’s all the hype? Here are ten advantages to using the seller carry back to buy or sell real estate.

1. Shorter Marketing Times – Properties marketed with “Owner Will Finance” will draw a greater response rate and generally sell at least 20% faster than properties requiring conventional financing.

2. More Buyers – With many lenders’ tightening their approval process, the seller carry back enables a greater number of buyers to purchase and finance a home.

3. Speedy Closings – Without the red tape of a conventional mortgage lender, a real estate transaction can close in as little as two to three weeks.

4. Maximize Selling Price – The seller has an opportunity to realize full market value for a property when providing financing. This is viewed as a sales concession in many markets.

5. Reduced Restrictions – Restrictive lending requirements don’t apply providing greater flexibility when it comes to the buyer’s credit history, down payment, debt to income ratios, and other underwriting criteria.

6. Fewer Costs – There are no expensive loan costs to worry about. A buyer can put the money they save on origination fees, points, underwriting fees, mortgage insurance premiums, and junk fees towards the down payment and building equity.

7. Interest Income – The seller is able to collect long-term interest since they are essentially acting as the bank by extending terms to the buyer. On average a buyer will pay back 2 to 3 times the amount of the mortgage on a 30-year term as a result of interest.

8. Installment Sale Tax Deferral – When property is sold at a gain and subject to tax there can be an opportunity to delay a portion due when reporting under the Installment Sale Method (Refer to IRS Publication 537, Form 6252 and speak to a qualified tax professional for further details).

9. Secure Asset – The balance of the purchase price is collateralized by the property. If the buyer stops making payments the seller can take back ownership of the home.

10. Liquid Asset – The seller owns a liquid asset, which is just a fancy way of saying somebody will purchase the note, mortgage, trust deed, or contract on the open market. Many sellers elect to sell their future payments to a note investor or note buyer for cash today rather than payments over time.

Seller financing offers a creative solution to financing real estate but there are some risks. For the flip side of the coin be sure to read the The Downside of Owner Financing – Disadvantages to Providing Financing. It also pays to consult with qualified real estate, tax, and legal professionals to make sure today’s solution doesn’t turn into tomorrow’s problem.

Author: Article written and copyrighted by Tracy Z. Rewey

Dear Tracy,

Can you please tell me what are the advantages of buying a note for RE, vs. buying the property “Subject To” the existing mortgage?

Thanks,

Alyssa

New York

Hello Alyssa, Fred wrote a pretty good article on buying notes vs real estate at: https://noteinvestor.com/buy-notes/invest-in-real-estate-or-mortgage-notes/