Tracking payments and being sure they come in on time each month is crucial to successful note investing.

Fortunately, there are third-party servicing companies that specialize in collecting payments. But how do you know which one is right for you? We have you covered with these 13 important questions to consider when selecting a note servicing company.

What Does a Note Servicing Company Do?

A note servicing company collects monthly payments from the debtor/borrower, applies to principal and interest, calculates the unpaid principal balance, and remits funds to the note holder.

The servicer can track real estate taxes and property insurance to be sure they are kept current and handle any reserve or escrow funds. They will comply with federal RESPA servicing laws along with any state requirements. At the end of the year, they send out the 1098 Mortgage Interest Statements to meet IRS reporting requirements.

What About Private Loan Servicing Companies?

Companies that specialize in handling accounts for private lenders or seller financiers are referred to as Private Loan Servicing Companies.

While they provide similar services, they are setup to work with investors who buy one or two notes at a time, rather than requiring contracts for large portfolios. This differs from the minimum account size required by most “big box” servicing companies working with mortgage-backed securities or government sponsored loans.

Where Is the Servicing Company Licensed?

The first qualification is to determine whether the company is licensed to service notes in the state where the property is located. Not all companies are licensed in each state. They may prefer to specialize in a certain state or region.

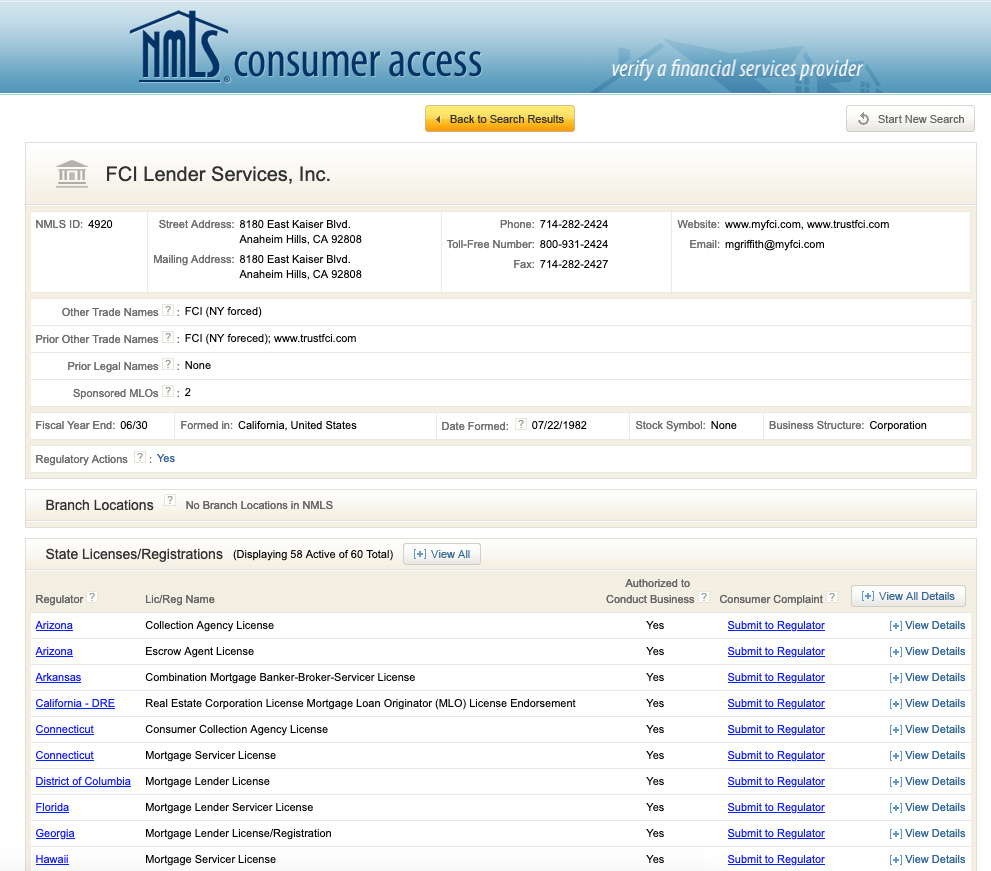

You can ask the entity where they are licensed and then verify. A handy place to check that out is the NMLS (Nationwide Multistate/Mortgage Licensing System) Consumer Access website.

First you enter the name, confirm you aren’t a robot, and the NMLS site will return a list of the licenses held, similar to the screen shot.

Depending on the state, the servicing license requirements and name will vary. These are commonly referred to as:

- Mortgage Servicer License

- Loan Servicer License

- Escrow Agent License

- Consumer Loan Company License

- Third- Party Loan Servicer License

- Collection Agency License

- And/or Debt Collector License

What Kind of Longevity, Reputation and Reviews Does the Note Servicer Have?

Once licensing is confirmed, it’s time to get familiar with the company’s history and reputation. How long a servicer has been in business can help investors feel secure in the experience and longevity of the servicer.

Check reviews online using Google Business Reviews or the Better Business Bureau. One word of caution. Being a servicer can be a hard and sometimes thankless job. There will always be a borrower that gets upset they were charged a late fee (for making a late payment of all things – gasp). Or that investor who doesn’t send in the required paperwork and wonders why the account took so long to setup. So, sift through the comments and reviews to get a feel for the overall culture and reputation of the company rather one or two off comments.

Talk with other investors to see what they say about the servicing company. Watch interviews or webinars and when possible meet with representatives of the company in person. Note Industry conventions like Cash Flow Expo, Note Expo, or DME are great ways to collect first-hand information on the reputation and customer satisfaction.

What Is the Note Servicing Fee Structure?

Servicing companies charge an initial loan setup fee along with an ongoing monthly fee for processing payments.

The loan boarding fee for adding a note to the account ranges from $50-$150+. The ongoing fee runs $20-$35 per month for a standard performing note.

Pro Tip: If you are working with a new note, you can arrange for the borrower to pay these fees as part of the upfront negotiations. Just be sure this agreement is included in the documentation. If not, it generally falls on the note investor to pay those fees. They can really add up and take a bite out of your return, especially on a smaller balance or smaller payment note.

Fees vary by company, so you’ll want to do your research. Typically, the fee schedule can be found on their website. You’ll also be asked to acknowledge the fee schedule when you sign the Loan Servicing Agreement. Ask for a copy upfront and read through it carefully.

In addition to standard fees, pay careful attention to add-on services. It’s typical to see extra fees based on loan size, escrows for taxes & insurance, collection efforts, loss mitigation, bankruptcy, loan transfers, additional disbursements, ARMS, HELOCS, Wraps, payoffs, VOM (Verification of Mortgage), data research, document prep, insurance issues, and other specialty items.

What is the Disbursement Schedule?

Once a payment is made and has cleared the borrower’s account, it is remitted to the note holder. When and how it is remitted can vary by servicer. Some will remit daily or weekly while others batch together and remit just once a month. This can be an important distinction, especially if there are underlying liens or other investors to be paid.

Servicing companies will deduct their fees from the payments before remitting to the note investor. They might also require a certain balance to be kept on reserve to pay fees that come up so be sure to understand how your servicer handles that.

How are Late Fees Handled?

When borrowers send in a late mortgage payment, most promissory notes specify an additional late fee that is due. For example, the note might say there is a 5% late fee due after the note payment is 15 days past due. If the payment was $1,500 then the borrower would owe an additional late fee of $75 on top of the $1,500 payment.

Thinking they’ll see that extra money in the disbursement, it surprises some note investors to discover the servicing company has kept all or a portion of that late fee. Many servicing companies work with a 50/50 split of any late fees collected from the borrower, while a few even keep 100%. Others have a sliding scale based on the late fee or loan amount.

What Collection Efforts Will They Make?

When the borrower is late, it is essential to start outreach. This includes both letters and calls, all staying in compliance with federal and state laws like the Fair Debt Collection Practices Act (FDCPA). Your servicing company is your best line of defense for this. On their side it takes extra time and effort. It is part of the reason many keep a portion of the late fee.

The type of collection efforts and loss mitigation management the servicer provides will depend on their structure. Servicer’s may define levels as standard, high touch, specialty, or non-performing loan servicing. Be aware this is where many of the extra fees mentioned start coming into play.

It can also result in the monthly loan servicing going up. That $20-$35 fee can increase to $75-$95 per month (or more) if a note becomes non-performing. This usually kicks in when the note is 90 days past due after 3 missed payments.

How Do They Track Taxes & Insurance?

The gold standard is to have escrow reserves or impounds collected for real estate taxes and insurance from the borrower. This monthly amount is equal to 1/12th the annual bill for taxes and insurance with the whole payment being referred to as PITI (Principal, Interest, Taxes & Insurance).

The servicer holds the TI portion in a reserve account and then pays the bills when they come due. This ensures that the taxes and insurance are kept current. There are specific RESPA laws pertaining to how those reserves are accounted for that your servicing company will handle.

If there are no escrows, then it is important to track that the borrower is paying the bills directly, keeping both taxes and insurance current. If they go delinquent, you want to take quick action through the servicing company to protect your interest as the note holder.

You will also want to know how your servicer handles a lapse in insurance. Many offer forced placed insurance through a national provider. Find out the cost and what action or approvals are needed to have that initiated. You don’t want an uninsured property.

Do They Hold Collateral File Originals?

Not all servicing companies are equipped to act as custodians for the original documents. Know where these are held and how they will be protected (especially the original promissory note, note allonge/endorsements, and other important originals).

What Online Functions Can the Note Servicer Provide?

Access to an online portal that enables login to check the account status, balance, and payment history is a valued resource. This is a benefit to both the note investor receiving payments and the borrower making payments.

It is also helpful if the servicing company is set up to take payments from the borrower online via ACH or credit card processing.

What is the Servicing Account Setup Process?

Once you have selected your note servicing company, they will work with you to setup your account and board the loan. Start this process ahead of time and give yourself plenty of time to avoid delays.

- Review and Sign the Loan Servicing Agreement including the Fee Schedule.

- Provide Disbursement Instructions including any Direct Deposit Forms or Tax ID requirements.

- Request a Loan Servicing Checklist to know what the servicer requires to board or setup a new loan for servicing. Ask questions if you are unsure or have a special situation.

- Submit a Complete Loan Boarding Package when the transaction has closed. This will differ for a newly created note versus an existing note. The servicer will likely have a setup form to send with the package. Be sure to use expedited delivery service with tracking.

- Check-in to be sure servicing company has received everything needed.

- Coordinate notices to Borrower of the loan ownership change and/or servicing transfer.

Ask any servicer and they will tell you receiving an incomplete loan boarding package (or sometimes no package at all) causes the most delays and misunderstandings. Any confusion also slows down timely payments from the borrower.

What Happens When Note Servicing is Transferred?

When an existing loan has been purchased or assigned there is a TILA Ownership Transfer Notice the new holder must send to the borrower within 30 days. This is part of Section 404A of TILA (Truth in Lending Act or Reg Z).

When transferring an account from one loan servicing company to another, the borrower must also be notified. Commonly referred to as “Goodbye” and “Hello” letters, the notices must contain specific information with the borrower notified at least 15 days prior to the effective date of the transfer. This is all governed by 12CFR Part 1024 of RESPA (the Real Estate Settlement Procedures Act or Reg X).

Work closely with your servicer to be sure these are handled appropriately.

Selecting the Best Note Servicing Company

Let’s be honest, it is a hassle to change servicing companies. That’s why it’s essential to get it right up front. There’s nothing worse than buying a note and having that first payment get missed. For that reason alone, you may decide to leave an account with the existing servicer.

Invariably, there are hiccups and payment delays, no matter how hard we all try to avoid them. While some borrowers are legitimately confused, it seems others use it as an excuse to pay slowly, knowing there is a 60-day moratorium on payments being considered late during a transfer.

Looking for a list of servicing companies that other investors like working with? Each year, we run a Best of Notes Contest where voters weigh in on the Best Private Loan Servicing Company for Note Investors.

Take the time to understand the process and get to know your servicing company. By answering these questions upfront, you’ll be on your way to choosing the note servicing company that is right for you!

As a note servicer, I will attest, there is a lot that goes into servicing a note. This article is very well written and should be used as guide for investors/lenders.

Thanks Sohail! That means a lot coming from a pro like yourself.

Great job discussing note servicers, Tracy. Thanks.

Thanks Marty! You’ve been around long enough to join me in remembering the days we self-serviced our notes. So much more protection using a third party servicer (and gives us more time to buy more notes)!