Nashville might be known as “Music City” but last week it became “Note City” for over 200 investors at the Diversified Mortgage Expo (DME).

In its 9th year, this two-day DME event created a space for note investors, service providers, note creators, and private lenders to network, learn, and expand their business.

On the way home, Fred and I talked about the highlights of the event. We’d decided to drive from Central Florida and combine with a family visit up to Michigan with a stop in Nashville. It turns out you have a lot of time to talk and reflect on a 2,600-mile roundtrip drive (and stop at a lot of Buc-ees to keep your co-pilot happy). Here’s our…

Top 7 Takeaways for Note Investors from DME 2024 Note Conference

Relationships Matter

There’s nothing like meeting face to face! That’s the number one benefit people talked about for attending. I’d have to agree. Getting to know the person behind the Zoom camera leads to stronger relationships and opportunity for future collaboration.

And what better way to get to know someone than throwing sharp objects two feet away from your fellow attendees? The conference kicked off with a Bad Axe Throwing competition which is one fun way to network. (Don’t worry. All limbs stayed connected).

Connection was a theme throughout the next two days (yep I made that segue). During the presentation on Relationships Over Transactions, Bob Repass encouraged us to see each other as counterparts rather than competitors.

In our own note investing journey we have worked hard to follow this principal. In putting core values of integrity, respect, and trust ahead of “closing the deal”, we have built relationships that have thrived for over three decades.

We Are All on A Journey

We are all on a note investing journey and everyone’s path is unique. This really came to mind as we networked and heard the personal stories during break-out conversations.

Our event hosts, Nathan Turner and his wife Rebecca, live in Canada. (There’s an obvious reason he’s called “The Canadian Note Guy.”). It’s one of the wonderful things about the note industry. You can do this from anywhere.

We also come from all walks of life, backgrounds, and prior career paths. Find what resonates with you, play to your strengths, and bring that unique perspective with you on your journey.

State of The Note Industry

Sourcing inventory, marketing for notes, and taking a pulse on industry changes are a big part of going to conventions.

Edward Seiler, an economist with The Mortgage Bankers Association, shared insights on the current market. While the Fed has paused rate increases, inflation is proving to be sticky. The rate reductions some had predicted for earlier this year didn’t happen. Now they aren’t being anticipated until late this year or possibly next year.

Between higher home prices and higher mortgage rates, home affordability has almost become an oxymoron (like jumbo shrimp or living dead).

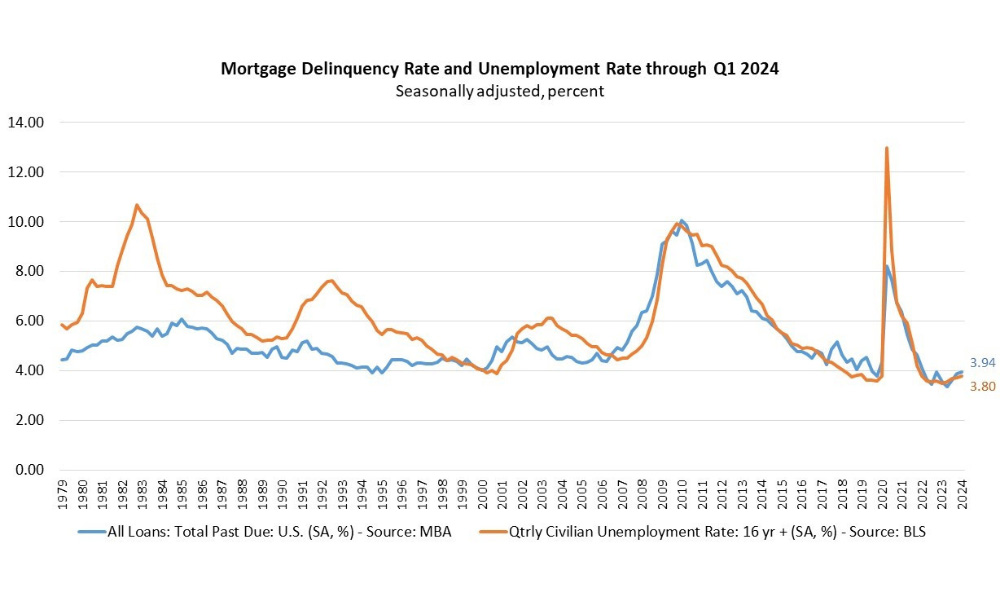

On the other side, home equity is up, and mortgage delinquency is down. There is a direct correlation between low unemployment and the mortgage delinquency rate. Of all the charts shared by the MBA at the event (and there were a lot of them), I found this one tracking the two together very telling, with both being at all-time lows below 4%:

The MBA economist projected that as long as unemployment stays low so will the number of defaulted mortgages. Further when delinquencies occur, many borrowers have equity to tap into giving them the option to sell for a profit rather than lose the property at a foreclosure. For more information visit the MBA Chart of the Week (Link: https://www.mba.org/news-and-research/research-and-economics/chart-of-the-week)

We’ve seen this have a direct impact on the number of non-performing loans (NPLs) being offered for sale on the secondary market. As that waterfall of distressed debt to buy has reduced to a trickle, more note investors are turning their attention to alternative sources like seller financed notes.

Creating Seller Financed Notes (that investors want to buy)

We love all the attention creating notes is receiving. It’s been our specialty since we got into the business 30+ years ago and it continues to play an important part of opening home ownership to deserving buyers that fall just outside a banker’s box of requirements.

During his panel participation, Fred was invited to highlight recent increases in seller financing from a report we publish each spring. (You can grab your copy of the stats here – Click Here).

When creating notes that investors want to buy, keep this in mind:

- Down Payment – 20% or more (10% Min.)

- Review Credit Rating

- Interest Rate – Fixed 9-10%

- Term – Fully Amortizing (20 to 30 years)

- Income – Ability to Repay (45%+/- Debt to Income Ratio)

- Reserves – Taxes & Insurance

- Servicing Through A Licensed Third Party

Looking for more tips? Visit our article with 10 steps for creating owner financed notes.

Alternative Note Varieties

While residential mortgage notes are the most common asset type, there’s many ways to approach note investing.

Nathan, asked several of us to share some of our unusual stories during the panel,

Have You Tried This Yet?

These are a few creative strategies discussed during the event:

- Buying Subject to Existing Low Interest Rate Notes

- Creating Wrap Mortgages or All-Inclusive Trust Deeds (AITDs)

- Incentivizing Early Payoff

- Private Lending to Real Estate Investors

- Using Partials to Recapitalize

- Borrowing Against Notes with Hypothecation

- Looking at Other Asset Types:

- Mobile Homes (with or without land)

- Land Note

- Business Notes

- Boat/Auto Notes

You can mix and match many of the strategies. I had fun describing a boat we seller financed on a wrap note when moving from Washington State to Florida. Now if only I had added a partial to that note structure!

Due Diligence Matters

While there were friendly debates on performing vs non-performing notes, 1st liens vs 2nds, and seller financing vs bank originated paper, one thing was unanimous – the need for solid due diligence. Underwriting the people, property, and paperwork are key to successful note investments.

Attorneys, servicing companies, note creators, and note buyers all generously shared their tips for protecting your investment and creating a checklist for note due diligence (click here for our Note Buyer Transaction Checklist).

During the final Monster Q&A session, the audience collectively shared problems and solutions faced on past deal. Of course, the Burn to Learn note buyer real deals story came up!

Raising Private Capital

As note investors we tap into a combination of institutional funds and private capital. Nate Dodson, Attorney with Investment Lawyers, explained how to navigate the SEC regulations when partnering and working with investors. It was excellent messaging and he agreed to present to our member group later this month.

I also enjoyed the super simple elevator pitch suggested by Yakov Smart, author of the book Attracting Investors. When sharing what we do as note investors say,

“I help people invest in real estate without having to do any of the work themselves.”

Then pause, allow the other person to lean in, and ask questions. What we do is a unique niche in the world of real estate, and it is easy to overload people with all the finer details. Our goal is to create interest at that first introduction.

What’s Up Next for Note Investors?

There’s lots of excitement for advances in tech for note buyers. From online platforms like Paperstac for accessing inventory, to the introduction of ChatGPT and other AI to simplify due diligence, we see opportunity to embrace new technology.

With less enthusiasm, we discussed the Corporate Transparency Act and developing a plan to comply through FINCEN.gov before year’s end.

We came away from the weekend feeling very grateful for seeing old friends and making new ones. It’s an honor to be part of this community and we hope to be part of it for another 30 years!

If you missed the event and still want to enjoy the networking, be sure to reach out to the sponsors of DME. The recordings of the event are also being offered along with attendee networking still going on in the Whova app.

The next note industry convention we’ll be heading to is Note Expo, Nov 8th & 9th, 2024 at the Westin Galleria in Dallas TX hosted by Eddie Speed of NoteSchool. We’ll be sponsoring and attending, so be sure to stop by and say hello.

Leave a Reply