I have written before about how note buyers accelerate payments on cash flow notes. One such strategy was the Double Your Payment/Cut The Interest Rate in Half.

I have written before about how note buyers accelerate payments on cash flow notes. One such strategy was the Double Your Payment/Cut The Interest Rate in Half.

Another method is to simply go for an Early Payment With Incentive.

To this day, the following situation is still my favorite example of this method.

It was late December and we were looking at a small note with a $10,000 balance. The payment was only $132.15 per month with a 10% interest rate and 120 payments left.

The note had been purchased at a discount for $6,000, which made for a 24% anticipated return.

Not bad…but we could do better! After talking to the payer we saw an opportunity to get an early payoff. They were very excited about their football team making it to the Super Bowl.

My comment was, “Tell you what. If you can pay off your note, in full, before the Super Bowl, we will give you a big screen TV to watch the game.”

They did payoff the note in full and received their TV!

So here is the math (and the chance for someone to win free access to Finding Cash Flow Notes)…

The payer made two payments on the $10,000 note bringing the balance to $9901.96.

We purchased a big screen television for $2,000.

That means we received a NET payoff of $7,901.96.

The full payoff was made at the two-month mark so we also received two payments of $132.15 prior to the payoff.

What was the yield?

The first person to leave a comment telling me the note buyer “return” wins free access to Finding Cash Flow Notes.

The fine print for calculating this cash flow note:

1. First correct entry wins.

2. I will allow up to a 1% variance due to slight calculation differences.

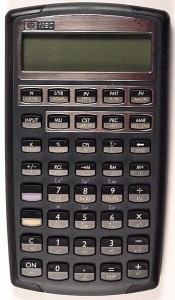

3. Once we have a winner I will update this article with the answer including how to calculate on your best financial calculator!

Good luck!

If you do not believe….review you mathematics in finances.

I did the calculation in excel and came up with 202%

My guess is that Excel just rounded up. That would have been a winner had it come in earlier! Good Job!

I get 83.35%. This is what I did:

N=120 I=10% PV=10,000 PMT=132.15

(after 2 payments) N=118 I=10% PV=9,901.36 PMT=132.15

the payoff is 9,901.96 minus the 2k for the TV =7,901.96. I bouught the note for $6k which means I have an overall investments of 1,901.96. So the numbers would look like this:

N=120 I=? PV=1,901.96 PMT= 132.15

Answer: I=83.35%

N 120

I 10

PV -10,000

PMT 132.15

FV 0

N 2

I 201.87

PV -6000

PMT 132.5

FV 7901.96

201.87% return

Regards,

Greg

We have a winner! Congrats Greg!

Greg already has Finding Cash Flow Notes Training – (maybe that helped a little bit?!)

So, since Greg has already taken the class, we will award the prize to the next closest winner.

Thanks to everyone for playing!

How about 138.87% yield!

WANT A HINT?

First off, everyone is in the ballpark in that no one said 12% or something like that.

Here is a hint.

Remember when calculating a cash flow that you start with solving for the payment. (There is always a few extra “rounding” dollars out there that will affect the yield).

I think it is 264%

A bit high Joe. My guess, go back and look a the amount in FV.

That was a calculation, not a guess. 🙂

But here is a guess — my number is slightly too low because I did not take into account the fact that one payment came a month earlier than the rest of the income.

Fritz, sorry, didn’t mean “guess” in that sense – anyone guessing would never have been that close. HINT: Your are a bit high.

No worries, I was just playin’ with you about the calculation vs guess 🙂

But please clarify…are we calculating based on a 6k investment, a payment of 132.15 a month later, and a second payment of 132.15 plus the payoff of 9901.96 (and the 2k expense) at the two-month mark?

Two very close guesses!

I’ll say a 200% yield.

Probably not the answer you are looking for, but I’ll say that is a 216.6% yield.