We talk a lot about investing in real estate notes and why we think it is a lot better than being a hands-on landlord. Let’s say this: being the bank is easier than being a janitor.* *Ok, you are not really the janitor, and there is nothing wrong with that profession. But sometimes, as a landlord, you feel like you have to do all the work (or hire people to do it). Fix … [Read more...] about If Notes Are So Great, Why Do Investors Sometimes Sell Them?

sell mortgage note

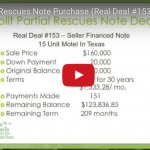

Split Payment Partial Rescues Note Purchase – Real Deal #153

Welcome to Real Deals! It’s always easier to learn from real life so here we share note investing information from actual owner financed transactions. When the mortgage balance is greater than the property value a partial purchase can rescue the purchase of a seller financed note. Watch the video below and discover solutions to overcoming 3 challenges on this real deal in … [Read more...] about Split Payment Partial Rescues Note Purchase – Real Deal #153

Selling Mortgage Notes – Mortgage Donation Or Write Off?

Someone wants to sell their mortgage note but they haven't received payments for a year, are in second position, or facing foreclosure. They need help but what can be done? Here is an option for non performing mortgage notes you might not have heard about...donating to charity. Our guest author works with a non profit organization with a unique solution to defaulted … [Read more...] about Selling Mortgage Notes – Mortgage Donation Or Write Off?

Buying and Selling Notes – What is the Current Property Value?

One of the considerations when buying and selling mortgage notes is knowing the current value of the home. After all, the property is the collateral and knowing its true value will greatly affect how much an investor will pay for a note. Historically this process was a bit easier, when everything was in an "up" market. But with property values still on the downside or just … [Read more...] about Buying and Selling Notes – What is the Current Property Value?

Questions on Selling Mortgage Notes

Owner financing is on the rise with more sellers agreeing to accept payments from buyers. There are many reasons people agree to a carry-back real estate notes including: Quick sale of the property Monthly income from the note No hassles of bank financing More qualified buyers Property that is hard to sell or finance Rather than waiting 20-30 years for payments, … [Read more...] about Questions on Selling Mortgage Notes