You are cordially invited to attend the Note Investing 101 training series. Join Fred Rewey and Tracy Z in these special live broadcast sessions for all the basics of real estate note buying.

In the Note Investing 101 Series, you will learn…

- Why so many people choose notes instead of renters.

- Why the “fix and flip” game is getting tougher.

- Who the note players are and how you get to profit from them.

- How to market for notes.

- The best ways to own notes.

- How to set-up a note business in less than 90-days.

- Why self-directed retirement accounts are hot right now.

- The difference between performing notes and non-performing notes and how to figure out which one is right for you.

- How to CREATE your own notes!

- And much, much more.

Note Investing 101 Series Schedule

- Episode 1 – Discovering Notes (This Page)

- Episode 2 – Profiting From Notes (Link)

- Episode 3 – Marketing For Notes (Link)

- Episode 4 – A Day in the Life of Notes (Link)

- Episode 5 – Ask Us Anything! (Link)

- Special Session – Behind the Scenes and New Member Orientation (Link)

- Episode 6 – Buying Notes in Retirement Accounts (Link)

- Episode 7 – Taking Your Note Business Online (Link)

- Episode 8 – Deal Analysis (Link)

Note Investing 101 – Discovering Notes

In this first episode of Note Investing 101 we will be starting at the beginning.

When is ‘Note Investing 101’ and WHY is this such a big deal you might ask?

We like to schedule live sessions to answer your questions and share recent news! To receive notice of the next live session along with video replays, please enter your email below.

Discovering Notes Session Transcript

Tracy Z: Hello and welcome! This is Tracy Z.

Fred Rewey: This is Fred Rewey.

Tracy Z: And we are excited to be here for our Note Investing 101 series. We’re going to talk about how to get a note business up and going in 90 days.

Fred Rewey: So, we decided to create an entire set of videos, kind of like a crash course, if you will. That’s why we’re calling it Notes 101. So, we have the ideas to show you how to build a business. If you’re new, then you’re in the exact right place. Cause we’re going to start at the very, very beginning. If you’re experienced, then you’re going to get something out of some of the later episodes, as well and maybe a couple of things along the way. But, it’s important that whether you’re here to get started or whether you want to get your business to the next level, we hope to accomplish that and share a lot of information with you.

Tracy Z: We’re going to talk about, just to get started, “Who is this industry for?” Fred and I have been buying and selling real estate notes for over 50 combined years. We see this applying to two main groups: people who want full or part-time income either now or in the future.

Fred Rewey: So, we’re also talking about real estate without tenants. We’re going to talk about this a little bit later, but you know, everybody loves real estate certainly right now. And you know, it’s like Mark Twain said, “buy land”, they stopped making it. There’s only one downside to having tenants. You know, it’s great when they’re paying your bills, but then you have the phone calls in the middle of the night and everything else like that. So, this is the advantage of being able to invest kind of in real estate and get all the benefits of real estate without having the headaches of the clogged toilets and the roof and the repairs.

Tracy Z: Right. Definitely. Well, the three T’s: tenants, toilets and trash. Sometimes they call it termites, but whatever it’s called, they are all headaches.

We’re going to talk about having a real estate backed-asset, which is known as a mortgage or a deed of trust. So you have an asset that you’re familiar with. Yet, as Fred mentioned, you’re the bank and banks don’t get calls at 2:00 AM for stopped up toilets or lockouts or kids flushing something down the toilet. So, the third group that might be here are people who are just looking to diversify their portfolio. We work with a lot of people who have self-directed retirement accounts and they’re looking for something besides the stock market or besides physical assets, like real estate. Real estate notes can be an alternative investment form for a self-directed retirement account and it can be done in and outside of a retirement account. It kind of depends on what your purpose is for the income. And we’ll talk about that today.

Fred Rewey: We have to do a disclaimer. We’re not investment advisors, we’re not telling you what to do with your money. Here’s the fine print. We’re not attorneys, we’re not giving you legal or financial advice. I know you’ve seen this, don’t eat yellow snow, whatever it is. You have to do your own due diligence. So just be aware.

Tracy Z: We’re not trying to sell you an investment or an asset or a security. We’re just here to talk about deals that have worked for us over the years.

Fred Rewey: Yeah. And which leads me to where I was going which is the, why us? Why would you be listening to us? And as Tracy mentioned earlier, we have over 50 years combined experience in the industry. We’ve done this for a very, very long time. Early in the nineties, late eighties, nineties, I was actually in a 500 square foot apartment. And I was taking some night classes by a gentleman by the name of John Richards, who has since passed away, but is well known in the note industry. And in that class, we were learning to buy real estate. But one week, he taught me the financial calculator and he purchased notes and he taught me that. And I thought it was the coolest thing ever. You know what I like to say a lot? I don’t like math, but I do like money. And so he taught us, taught me how to do that. He taught the entire class and I was hooked. So, I actually started my business in a 500 square foot apartment.

But anyway, so that’s where I started. And then, I actually joined up with another investor and was one of the largest investors in the country. Then I went to the other side and joined a funding team where I met Tracy. And then we left it all. How many years ago? 25 years ago.

Tracy Z: Yes. So, what’s interesting about your story that I really like is that you learned about this taking a real estate class in college. Don’t you wish that they taught this sort of information in all colleges? I mean, you just were fortunate that the person teaching the class knew about real estate notes.

Fred Rewey: Well, schools don’t teach you real estate, or they don’t teach you money and they don’t teach you relationships. And they’re probably the two biggest things in your life. Ours were together, which is really weird.

Tracy Z: As Fred mentioned, we come to notes a little bit differently, but we met through the note business. He started out on the side of flipping notes and I started out on the institutional investor side. I had a real estate and closing background, worked for an attorney, and a small company that had a title company. I learned about seller financing because it was a small rural area. And I moved to what was called the big city of Spokane. And that was in 1988. I went to work for a gentleman, that had already been buying and selling seller finance notes for 30 years. So, they had started in the forties and fifties andI began in 1988. I was the person doing all the paperwork, understanding the due diligence and helping them expand their portfolio so that they were buying $20 million a month from people like Fred and his group that would bring the notes to us.

Tracy Z: We came up from an institutional investor side and from that side, we also were securitizing notes and putting them in portfolios that could be sold on Wall Street. We were taking that seller financed paper and trying to turn it into something that will look more like bank paper. In 1997, we started our own company together. And we also started the NoteInvestor.com blog, which is really a labor of love, right?

Fred Rewey: There’s a ton of information. If you go to www.NoteInvestor.com, there’s a ton of information there. And it’s grown over the years. It became, well, you know, one of the most…. What’s that called?

Tracy Z: Authority site.

Fred Rewey: Authority site. Thank you. We don’t hold anything back. At this point in our lives and with what’s happened to us and what we’ve been fortunate to do, it’s a matter of giving back. So, we created NoteInvestor.com a couple of years ago, we created CashFlowExpo.com. I noticed several people here on the show that were at Cash Flow Expo, where we brought together a group of speakers to share their expertise. We’re just passing on information, paying it forward, if you will. And then, Tracy is largely behind the creating the Personal Profit series.

Tracy Z: Yeah. So, we have a Personal Profit series manual. It’s a 475 page manual. It’s for all the detailed people who like to see the documents and how due diligence works. We also did a calculator class. It teaches people how to use a financial calculator. But today what we really want to talk about is how we have used the note business for ourselves. So, we’ve seen it from the institutional side and then we started our own company and we bought and sold notes and placed them retirement accounts. We’ve used lines of credits. We’ve flipped some notes or rehabbed some for profit. And so we’re here to talk about that because we think it might be valuable to you to see how we’ve done it. And because we have three decades of doing this, we’ve seen this work in good economies and slow economies and crazy economies, like 2008. We’ve seen it through all different cycles. Today we want to talk about where’s the opportunity. And then we want to hone in on the seller financing side as well. So, there are three main areas of opportunity for deal sourcing, in my opinion, if you want to buy yourself notes. And so the first one would be.

Three Areas of Deal Sourcing – Seller Financing, Non-Performing Notes, and Creating Notes

Fred Rewey: Seller financing and that’s the deal we’re going to talk about. And that’s sort of a traditional deal. And we’re going to go through an example of that. And you’re going to have that down cold here in just a minute with our little magnet people.

Tracy Z: Yeah. That’s where we got our start. That’s where in the eighties, we were focused. They also could be the form of non-performing notes. You usually see a lot of those on the note listing sites that you might’ve seen, like Notes Direct or Paper Stack. Although, they sometimes also have seller finance notes as well. But what’s interesting is until the 2008 subprime lending crash, non-performing notes were not really something we dealt with. We found our inventory was seller finance notes. So, there are still non-performing notes out there today. We’re going to talk primarily about performing notes. We can save the non-performing notes, maybe for a future session. And then, the third thing that we want to talk about is the creating process.

Fred Rewey: That’s basically where instead of going out and trying to find notes, you’re actually creating notes. This is really attractive to people that are used to flipping properties or people that have properties they want to sell.

Tracy Z: Yes. And so in creating notes, in addition to doing that with property, do you want to buy or sell? And also you could actually originate a loan as a private lender to another investor. So, that’s something else popular. So, those are the three main areas of deals sourcing. People always wonder where these deals come from, seller finance notes, non-performing or re-performing, and then also how to create your own notes. So, we are excited to have you here. So, what we’d like to do now is kind of hone in on the seller finance notes.

Seller Financed Notes – The Numbers

Tracy Z: In general seller financing is about 6% of all real estate transactions. Now, that can be more or less. Some States have less. It’s not as familiar. Some States have more, but that’s just an average. So, we’ve actually got some cool stats that we’re going to bring up on the screen to show you just how big it is, because this always surprises people.

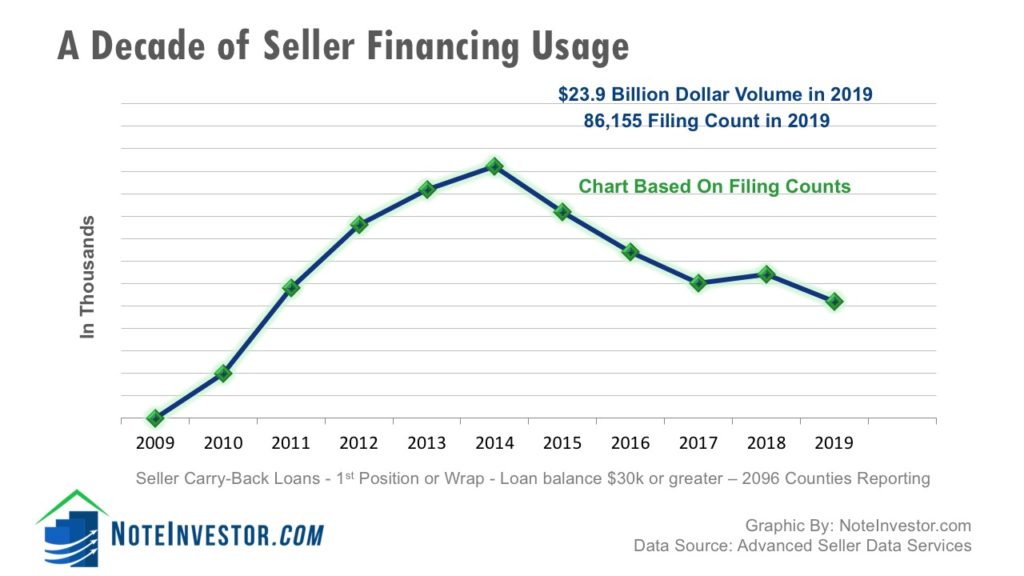

Fred Rewey: The first thing we want to show you, graphically up here is just how big, how much money we’re really talking here. And the answer to this from last year, because where it’s trailing year and gathering information is 23.9 billion with a B. So, that’s 113.8 billion in the last five years. So, it’s a really, really big market, much bigger than people think it is.

Tracy Z: Yeah. You just need a little slice of that pie. So, in addition to there being $113 billion plus in the last five years, this is made up of a lot of different things. This is made up of residential, commercial, and land. We’ve got the residential made up of about 39%. And when you’re talking about the dollars, land made up about 25%, commercial made up 18%, and then we had this little bit that was unknown and it pretty much all comes out about similar ratios on that. That just meant that the county where this data was obtained from, didn’t identify easily what the property was. So, where did this data come from? Well, this is public records data. So, whenever you buy or sell property, a deed gets recorded. And whenever you get a loan, a mortgage or a deed of trust gets recorded. And so this data shows that the person that sold the property also got the mortgage or the deed of trust. So, this comes from public records. We work with a company to get this data and they’ve been tracking it for us for quite some time.

Fred Rewey: Yeah. We have a graph that shows the tracking of it. This actually gives you a decade of seller financing usage. This is how much, and you can see that it went up, obviously back in 2013, 2014, you can see where it kind of hit the highest position there. And if you look at interest rates, you can see where these correspond.You can see lately it’s come down, but it’s still a huge, huge number. It doesn’t matter to us as long as there’s always inventory, which there is. So, in this case, and I think what’s going to happen now is you’re going to start seeing it tick back up pretty soon here.

Tracy Z: Financing fills a need when the lenders start to restrict their criteria and they want a higher down payment, a higher credit score that makes fewer people qualify for traditional bank financing. And so in those situations, we see that the percentage of seller financing goes up. Unfortunately, we can’t deny what’s happened in last year. Wow! It’s been a crazy year. So we hope we find people well and healthy and also trying to think, how can they help people in the future? And this is one of the ways I believe will help, seller financing is going to help some people get back on their feet that have been hit a bit hard by life. So let’s show them a transaction, how that might look, right?

Seller-Financed Note Transactions

Fred Rewey: Now we’re going to take a step back. And those of you that have been in the industry for a while, just kind of bear with us for just a second. The purpose of this series is to not leave anybody behind. So, we’re starting at the very basics. And then as the series progresses and we do more of these videos, you’re going to see that we get more and more advanced, but we do want to start at the very, very beginning. So, basically here we have a house [displays house magnet]. This is the way a typical transaction would work without any type of notes situation. And what do we call this guy? [displays a man]

Tracy Z: Sam, the seller.

Fred Rewey: Sam, the seller. There we go. It is the Dr. Seuss of home sales. So, Sam, the seller just wants to sell his house and somebody comes along to buy the house.

Tracy Z: And we’ll call her Barb, the buyer. And what traditionally happens, right? Is Barb, the buyer goes and gets a loan from the bank.

Fred Rewey: Yeah. So, she’s going to borrow money from a bank to pay Sam. Well, first let’s say the bank has the money. So, she’s going to get a loan from the bank. And then the bank is going to send the money to Sam the seller. And then, she gets the house and then he’s going to go away with his money and she’s going to continue to make payments to the bank.

Tracy Z: Yeah, Traditionally 30 years.

Fred Rewey: Yes.

Tracy Z: That’s where we start here because everybody understands this. If you bought or sold real estate or bought or sold a hom, you understand that if you don’t have the money to pay cash, you borrowed the money from the bank, the seller gets their money and then the buyer makes payments to the bank. So, in seller financing, it’s just a little bit different. So, in that situation, we still have Sam the seller and we’ll still have Barb, the buyer.

Fred Rewey: There’s a couple of reasons this happens. Well, it depends what happens in the environment, but this could have been a property that was harder to sell for some reason. Sam could have been insisting on getting a higher sale price. He might’ve really liked Barb, but Barb didn’t qualify at the bank. Maybe she went to get a bank loan and doesn’t qualify, maybe heaven forbid she’s self-employed and doesn’t qualify. You’re going to see a lot of people come out of here that are really good people that have a single life circumstance like what’s happened in the last year, that all of a sudden don’t qualify for bank loans. And even as low as the interest rates are, they’re just not going to be able to get loans and in some areas it’s very common. Like we said 6% is a plus or minus national average, but in some states it’s a much higher percentage because that is the normal way of doing it. Sam the Seller may also simply want to carry back a note because it’s a good return for him. And we’re going to talk about that in a minute. So, in that particular case, he’s going to carry back a note and you want to talk about how he does that?

Tracy Z: In this particular case to Sam, the seller sells to Barb, the buyer. So she is closing, she’ll still get her deed. But what she’s going to sign, is a lien over to Sam, the seller. And so in this case, she’s going to have a lien and that’s going to be secured. The lien is evidenced by a promissory note in most all States. But what might change is that instead of a promissory note, in some states it’s a deed of trust. That is what secures the promissory note. And in some states it’s a mortgage, but basically the lien is what’s recorded either the mortgage or the deed of trust in the county. Barb the buyer gets the deed and she signs a note back to Sam, the seller.

And then they put a lien on the real estate that says, if I don’t honor my promise to pay, you can take the property back. So in this situation, what happens is, instead of there being a bank, Sam, the seller becomes the bank. And every month Barb, the buyer, sends the payments to Sam, the seller, and hopefully they use a third-party servicing agent to collect those payments every month. Because they’ll keep packing principal and interest and do the collections. And that’s what makes it so passive. It’s kind of like, think of the servicing company as a property manager for your note. But they’re not managing the property, right? They’re managing the note. But the great news is that they usually are available for $20 to $30 a month. Far less than a traditional property manager. Every month Barb, the buyer makes the payments to Sam, the seller. She puts some money down and he stays in the picture. Right?

Fred Rewey: Yep. To pause for just a second, because I think this is an important distinction. I’m going to lose the paperwork just briefly, just to understand what all happens behind the scenes. And it’s no different than if this was me and this was Tracy. And I said, Hey, do you want to buy my house? And Tracy’s going to pay me so much a month to own my house. We’re going to do all the paperwork to protect Tracy. We’re going to do all of the paperwork, to protect me. But as long as she mails me payments every month, she will eventually own the house. And we have paperwork in the back so that, if she doesn’t pay me and things like that. But that’s essentially what we’re doing. We’re removing the bank. I’m happy because maybe I didn’t want all the money in a lump sum, or because I’m going to create an interest rate and say, Hey, Tracy, you’re going to pay me 8% a month on that. And so now I’m going to earn money while I have the note. So we’re going to talk about buying those in a second, why this is very important, but this is how essentially this person created their own note. We talked a little bit about creating those. This could have been a rental property that he no longer wants to run out inside. And then he sells it to Barb and now Barb is going to make payments to him. But the important distinction is there’s no bank involved.

Tracy Z: Yes. Now, sometimes Sam, the seller might still owe money to a bank. And we can talk about that in a more advanced strategy, because this can be done without owning properties free and clear. But in this particular instance, he sold it to Barb, Barb makes payments to Sam, the seller. So now, okay. So, there Sam, the seller. So how, where we come in, how can we get involved?

Get Involved – Investing in Seller Financed Notes

Tracy Z: There’s a couple of ways that you can participate in our industry. Let’s say Sam, the seller, is getting payments every month because he sold to Barb, the buyer, and he likes being the bank. He has all the rights of the bank, but he would like to get some cash.

He’s tired of a small, monthly payment trickling every month. So people market including Fred and I, and you can too. We market to these people and we get our own pictures out there. We say, ‘are you receiving payments on property sold? We pay cash today, sell all or part of your payments and you receive a lump sum of cash.’ And so we market to people like Sam, the seller, and they contact us and ask for a quote. And in that situation, we can either buy the note and earn a great yield, or we can flip the note to another investor and earn a fee. So if we were to come into this situation and buy the notes, say in our retirement account, then Sam, the seller would get his cash from us.

Fred Rewey: He goes away.

Tracy Z: And we get an assignment of his interest. And we now get the payments from the part of the buyer. So, in that situation, we’re happy. We’re an investor, we’re earning a great return. We have the same position as a bank, as far as like, if Barb does not make the payments, then we are able to foreclose and take the property back, but Barb’s paying along great. And we’re receiving payments, but if we don’t have money to buy the note, or we don’t want to buy that note we have another option.

Fred Rewey: What we can do is actually flip that note over to a group of funders. And so, and we’re going to show you the numbers in a second. So if we have our own money, then we are basically going to pay Sam, the seller, to step in and take over his position. And we’re going to take his place. We’re going to give him cash, whatever we agree on. And then we’re going to receive the payments. If we don’t have our own money, then we are going to flip the deal to an investor simultaneously. So that, they put up more than the money. So we agree on a price. They put up more than enough money to pay for Sam plus something else for me, for the flipping on that. So we’re going to use their money to buy Sam’s note. And then what happens when this is all done? Sam walks with his money. We walk with the little money we made. The funding source is the one that’s going to get the payments.

Tracy Z: Yep.

Fred Rewey: Hope that made sense. If not, you’re going to see this over and over again, because we will be talking about the same type thing.

Tracy Z: Excellent. All right. So, let’s go to the numbers now.

Fred Rewey: All right. So we’re going to look at the numbers and this is where it really gets kind of fun. And this is the exciting part because, and you’re going to see why this industry is so flexible.

All right. So interest rate aside, and, you know, maybe the properties cost more or less than your area. Maybe the interest rates are more or less depending on what’s going on the market, but I’m just going to use this number. And we’re going to say the sales price is $120,000. This is what they’ve agreed to purchase for. There’s going to be some sort of down payment. So there’s going to be a down payment of $20,000. Is that a good down payment?

Tracy Z: Yeah. I like to see personally 20% or more, but yeah, that would be a little bit less than 20%. It’s what about 18%?

Fred Rewey: Yeah, I think it’s a pretty solid down payment. You know, and in the last year, by the way, and I did see some interesting numbers the other day. There’s a lot more people having cash. So, that means after the down payment, we’re going to create a note of a hundred thousand dollars. That’s the amount. So it was $120,000 sale price, $20,000 down payment. We have a hundred thousand dollar note. So, we’re going to do that over. How long are we going to give her? Let’s do a traditional 30 years. Okay. So it’s going to be a 30 year note, which is 360 payments. So we’re going to say 360, and we call that N for ‘number of payments’, and we’re going to do an interest rate. I’m going to do 10%.

Tracy Z: And I know you’re all thinking, this is shocking. Who’s paying 10%, but we find a lot of seller finance notes that are in the eight, nine, 10% range.

Fred Rewey: These numbers are all negotiable. If I really didn’t want to carry back a note, and this was my hot button and go, you know, I want 10%, if you don’t want to pay me to 10%, go get a bank loan or go find another way to do it. But this could be whatever we agree on, but let’s just say for the purpose of the example, we’ve done 360 months, which is 30 years traditional mortgage at 10%. So the payments on that are actually going to be 877.57. That’s how much Barb is going to mail Sam. I’m really bad at names. But I’m good at numbers.

I don’t have a vested interest in this, $877 every month to Sam, the seller. And that’s the note, that’s the cash flow. That’s what we’re looking to buy. Now, let’s say Tracy comes along and Tracy is this group here. Tracy is the investor. And she wants to buy it for herself. Let’s not talk about flipping or anything right now. She wants to buy it for herself. What do you want to earn on your money?

Profiting with Note Discounts

Tracy Z: I would like to get 11% return.

Fred Rewey: So Tracy wants to earn 11% on her money. Now we’re going to, there’s a whole lot of reasons this wouldn’t happen because we always have some sort of discount. But let me say this. If Tracy wanted to earn 10% on her money, and she came in at the exact moment, this all started, she could pay him a hundred thousand dollars. She would receive the 877.57 and a 360 payments. And she would be earning 10% on her money. But this is where the magic of the industry comes. She doesn’t want to earn 10%. She wants to earn 11% on her money. We can’t go back to Barb and change the numbers. So what do we do?

Tracy Z: We understand the time value of money. And we put it in our financial calculator. And we say, if I have a hundred thousand payable at $877.57 for 360 months, and I want her 11%, what’s the present value of that cashflow. And that is the amount that we would pay. So in this case, it turns out to be approximately.

Fred Rewey: $92,150.

Tracy Z: Yes. If I wanted to earn 11%, I could pay Sam, the seller, $92,150. He would get his $92,150. He would sign an assignment of mortgage or assignment of deed of trust. And you would endorse the promissory note. I would get the original promissory note. I record an assignment and he gets money and goes on his way.

Fred Rewey: The way we get the money is, by paying less money for the entire note. We’re paying $92,150 for a hundred thousand dollars. So that’s the discount. So we’re paying less money for the same cashflow. So it’s always going to be 360 payments of $877.57 that cannot change or will not change unless we agree on something. And that’s a whole different scenario, but that is what, so basically that’s a hundred thousand dollars. If we pay less for it, then the yield is going to go up. The return is going to go up.

Tracy Z: In that case, we could buy that in a retirement account. If we leveraged it, if we had costs of funds say 5%, and we’re making 11%, we’ve got arbitrage of 6%. Those are different ways as an investor that you can do it. But let’s say you find this note and you don’t have the funds available right now to buy it, but you still want to do the deal. There is opportunity. So, let’s look at flipping a note or wholesaling a note.

Flipping Notes

Fred Rewey: So what we would do is, is we would actually contact the funder. And we would ask the funder, we’d say, Hey, this note is for sale. How much are you willing to pay for this note? So, they said, okay, so we’re going to pay, we’re going to pay $92,150. Now, Tracy, you don’t have $92,150 right now. So you’re going to flip the note on to these people, but you’re going to get paid for finding the notes so much. What do you want to make?

Tracy Z: I would be happy making, I mean, it would be a low fee, but yet be happy making that $2000. Any day!

Fred Rewey: We’re going to take off $2,000 for ourselves and that’s going to give us.

Tracy Z: $90,150 to pay them. So at closing, we signed an option. And then at closing, that’s assigned to the funder. They know this as it is all transparent. They know exactly what’s happening. It follows their due diligence procedures. They ordered the title, they ordered a BPO or some kind of valuation of the property. They do their check on the payer, the three P’s as we call them the payer, the property and the paperwork. And then at closing they’ll wire $90,150 to Sam, the seller. And they’ll wire the difference, the $2,000 referral fee to us. And in this case the funder is paying all the costs associated with that. So that’s just a net fee. So on transactions like that, we see on average, the average tree is about 3% to 6% of this amount the funders and investing. Now, sometimes it’s more on smaller deals, a higher percentage. Sometimes it’s less on bigger deals as far as the percentage, but that is how you can make a referral fee in the industry if you don’t have funds to invest on your own.

Taking Questions on Investing and Wholesaling Seller Financed Notes

Fred Rewey: Yep. So let’s see if we have any questions here [from the live session]. Is there a usury concern? It’s a great question.

Tracy Z: So, there are different usury rates in different States. So you do have to check that out. There’s also, if you’re creating notes, there’s something called Dodd-Frank and high-cost QM, more Qualified Mortgages. So, what we recommend in those cases is that you work with an MLO, a Licensed Mortgage Loan Originator, who understands seller financing. And we have some that if you’re going to create a note, if you’re brand new, the seller creating that, then we recommend that you do that to create the note, just to make sure the buyer qualifies. But you as an investor discounting the note, that’s not usurious, you’re not making a loan, you’re not charging them interest. It’s just like buying a property at a discount. So if you’re buying a note, at a discount just like buying a piece of property at a discount.

We do everything above board. There are some exemptions to Dodd-Frank and using an MLO, if you’re doing a one seller finance transaction in 12 months, but I recommend you just go ahead and use it anyways, because it is just paperwork and set up just like a banquet qualifies and you get to choose the underwriting as far as what score and down payment, those sorts of things that they would have. And that’s been a big change in our industry since 2014 and we all adapted a little bit, but I think at the end of the day, it probably made the paperwork better quality.

Fred Rewey: Yeah. And again, this only applies if you’re creating notes, which we will go into another video.

Tracy Z: You’re just buying at a lower price and that’s not usurious because you’re not charging anyone interest. You’re just discounting it.

Fred Rewey: Yep. Darryl said, do you use a title company? Absolutely. Yeah. That’s what we do the closing through. So we close it similar to a real estate transaction, except it’s just different paperwork, but basically you’re what I mean, how else would you say it.

Tracy Z: We always use a title company. There’s two different types of title. There’s a title report and there is a title insurance policy or commitment for insurance. If you’re working with seller finance transactions, then we definitely suggest getting title insurance because you want to make sure you’re coming in after the fact that the note was created properly. If you’re creating notes, you want to make sure that is also done properly. If you’re buying that bank paper that we talked about and that title policy called the lender’s title policy already exists, then you might be able to just get a title update because that lender’s policy will often go to your benefit to this successors and assigns. That would be a more advanced topic, but the title is where I learned the business. So I love, look, you have follow-up questions on that. We can all definitely discuss that, but we do involve the title company, whether you get title insurance or title report will vary on the type of paper you’re buying and whether or not a title policy parties.

Fred Rewey: Yep. And one more question and then we’re going to stop for this video. Theresa said, “would the group be paying 94,150?” No. And let me explain why this is such a great question. It’s a common one. So before this exists, what we’re doing is we’re actually finding out how much will the funder pay for this note? And the funder said $92,150. So it’s an important thing. And a lot of people have made this mistake before because you didi’t add your fee. You subtract it from what they’re going to pay. So if they’re offering 92,150, we have to take something off of that to offer Sam the seller, to cover our fee. And we say, okay, we want to make 2000.

So, we’re going to take $2,000 off of the 92,150. Now, the net we have the offer Sam, would be the $90,150, and that’s how we would be able to do it. I’m going to do a follow-up question. Why would the seller only take $90,000? And it’s a great question. A lot of times when Sam, the seller first makes the transaction, they think that they’re going to be happy for 30 years. They’re going to be happy collecting $877.57 a month. And that’s just the way it’s going to go for the rest of their lives. In reality, and usually in either a short period or two to three, three to four years on average, something changes in their life. It could be good. It could be bad. It could be, they’re going to send their kid to college. It could be something medical. It could be, they just need to sell it to do something different. So a lot of times, this $877 a month is just not going to cut it. Maybe Sam wants to buy a boat. Maybe he wants to invest in a business. Maybe he wants to buy another house. It could be anything, but this is not enough money. And he can’t just walk into, you know, a bank.

And say, “Hey, I got this note” and sell it to the bank because most banks won’t even have a clue or won’t even touch it. So, that’s why it goes to a market for investors like us and why we buy at a discount. And in reality, if someone would have walked up to Sam at the time and said, Hey, you know what, you know, we take, we sell this for $110,720 cash. He would have taken it. So as long as the discount makes sense in everybody’s world, he’s going to get $90,000 cash now, as opposed to waiting over 30 years to collect his money. So, there’s a lot of different means. And we’ll talk about that in another episode, why the discounts are and how they show up.

The Partial Purchase in Note Investing

Tracy Z: In fact, the next episode, we get into something called The Partial Purchase

And the reason we talk about The Partial Purchases, we can give them full face value without them taking a discount. If they’re willing to take some money now and some money in the future, and that’s how we structure a partial purchase. So that’s a great setup.

Fred Rewey: The coolest thing about this industry.

Tracy Z: Honestly, we love partials. We’re partial to partials. They’re one of our favorite things. And so, we are so appreciative that you joined us in this session.

So, if you go to www.NoteInvestor.com/101, You will put in your email (sign-up form above) and we’ll give you a free copy of Our Five Ways to Cash in on Cash Flow Notes. And we’ll give you a free eBook on 21 Tips for Note Investing. And then we will also send you the link to the next session. So, our next session will be coming up.

And in our next episode, we’re going to talk four or five different deals of how you make money on them. And we are also going to talk about those partials.

So, we appreciate you being here. The Note Investing world has been good to us and we enjoy sharing it with others. And as you saw, there’s 23.9 billion a year. So, there’s lots to go around. And it’s just a way for private investors to be able to make the money like the banks do.

Fred Rewey: And we’ll see you on the next video.

Tracy Z: Happy Note Investing!