How to use seller financing to create real estate notes for cash flow or resale.

You’ve probably heard the call to “Be the Bank” or use “OPM” (other people’s money) for investing. Selling or buying property with owner financing is one method of using creative financing techniques.

Over the years it’s been done well, tragically wrong, and somewhere in between. In this article we will cover:

Market Size of Seller Carry Creative Financing

Why Use Seller Financing?

A Seller Financing Example

Building Your Owner Finance (OF) Team

Using MLOs For Dodd-Frank Compliance

Optimizing Mortgage Note Terms for Resale

10 Steps to Creating Notes

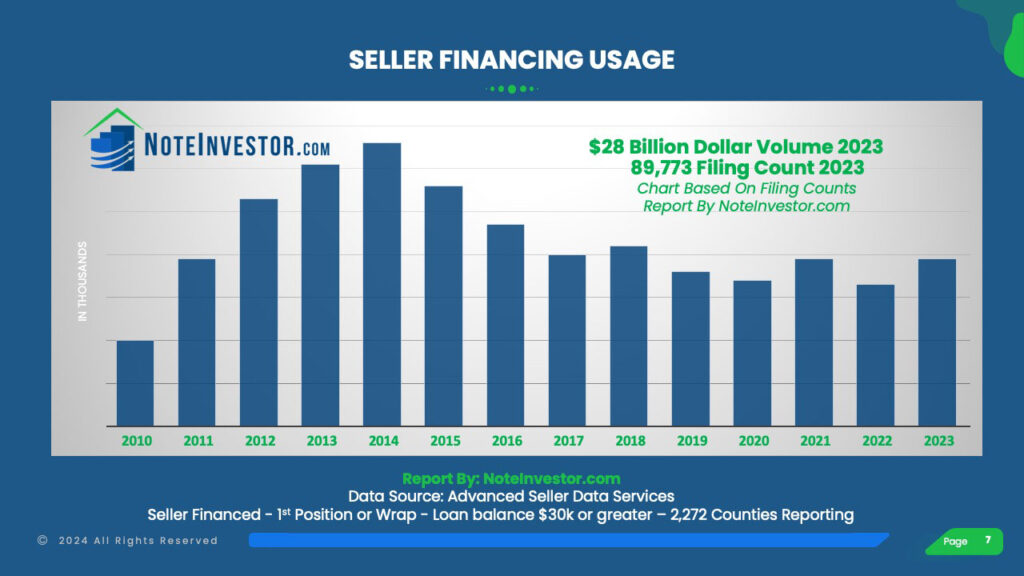

What Is The Market Size Of Seller-Carry Creative Financing?

In the past five years, over $125 billion in owner financed notes have been originated with creative financing. This includes residential, commercial property, and land where the owner of the property took back a 1st position seller-financed loan greater than $30,000. That number goes up when second liens,or unrecorded Contract For Deeds (CFDs) are included.

This form of private financing is used all across the nation with Texas, Florida, California, North Carolina, and Georgia being the top producers in 2023. A decade of tracking these seller financing stats shows the need for private mortgages goes up when traditional bank financing is harder to obtain and then level out in a balanced market.

Think seller financing is all about ugly houses, low price-band homes, and zero down payments? It might surprise you to know the average balance comes in at $248,523 on residential properties and the average loan to value (LTV) was 74% in 2023. That means most buyers using owner financing put over 20% down.

Why Use Seller Financing?

After three decades of working with private financing, the reason sellers offer financing usually fits into one of these buckets:

- The Buyer Has Issues

- The Property Has Issues

- It’s A Well-Planned Investment Strategy

Why Buyers Seller Finance

It is easy to see the advantages for buyers purchasing with creative seller financing. They get to deal with the seller and avoid working with a bank. That means:

- No costly loan fees

- No private mortgage insurance premiums, and

- Less restrictive underwriting in the areas of:

- Down payment

- Credit scores

- Proof of income

- Self-employed income

Overall, seller financing is easier, faster, and less restrictive than traditional bank loans. While they might pay more in interest they usually save on upfront costs. Once a buyer establishes a good payment history and improves their credit scores, they can often refinance at a lower rate.

Why Sellers Offer “Owner Will Finance”

The average seller of property wants full asking price, a cash buyer, and no costs. So why would they consider owner financing, especially when notes are typically sold at a discount?

There can be advantages for the seller to consider offering a property for sale with financing when there are property challenges:

- Property type is difficult to finance through traditional third-party lenders

- Property has been on the market for 90 or more days

- “As-is” closing is desired on a property in need of repairs

- Ownership has not met minimum holding time or title seasoning requirements of traditional lenders

- Immediate closing required in the event of foreclosure or other financial burden

- Quick closing is preferred by seller to free up investment capital

Other sellers look at owner financing as part of their real estate investment strategy to:

- Convert rental income to interest income

- Maximize selling price

- Increase prospective buyer pool

- Utilize the installment sale tax advantages for deferral of capital gains under IRS Section 453 covered in Publication 537

- Leverage property when buying or selling (including wrap notes subject to underlying financing)

- Generate long-term interest income

The last one is a personal favorite. If you have a $100,000 mortgage at 9.5% interest amortized over 30 years, the monthly payment would be $840.85. If the buyers took the full 30 years to pay back the loan, they will have paid $302,706 over time. That’s an additional $202,706 due to interest! After all, why should the banks get all the benefits of interest income backed by real estate?

A Seller Financing Example

A seller financing transaction typically involves a Deed from the Seller to to the Buyer and then the Buyer signs a Promissory Note and Mortgage back to the seller (instead of a bank).

In some states a Deed of Trust, Trust Deed, or Security Deed are used instead of a Mortgage. In other states a Land Contract or Contract For Deed are used. Other standard closing documents and disclosures would also apply.

Here’s a look of at a seller financing example using a first and a second lien:

| Sale Price: | $100,000 |

| Down Payment: | $ 10,000 |

| Seller Financed 1st: | $80,000 |

| Rate/Term/Payment: | 9.75% for 240 months @ $758.81/month |

| Seller Financed 2nd: | $ 10,000 |

| Rate/Term/Payment: | 9.75% for 120 months @ $130.77 |

| Total Payment Principal/Interest (1st & 2nd): | $889.58 (plus 1/12 taxes & insurance) |

Building Your Owner Finance Team

If you plan to owner finance, you want to start by identifying important members that can be part of your OF team:

- Real Estate Attorney/Escrow Closing Agent – Legal counsel can prepare documents and handle the closing.

- Title Company – Don’t overlook title reports and insurance when using owner financing

- Real Estate Agent – Property can be handled for sale by owner (FSBO) or with a real estate agent. The majority seller finance deals we see still involve a realtor.

- Accountant/CPA – Tax pros will help calculate the tax implication and tax deferral under installment sale method.

- Mortgage Loan Originator (MLO) – When selling to an owner-occupied buyer an MLO can help qualify the buyer and be sure they can afford the payments.

- Servicing Agent – Use a third party to collect payments, keep track of taxes and fire/hazard insurance, make collection calls, and handle the annual interest statements.

- Self-Directed Retirement Plan Custodian (aka SD IRA) – Real estate and real estate notes can be bought and sold out of a retirement account providing profits tax-deferred or even tax-free.

When working with seller financed transactions remember, these are licensed services so work with qualified professionals:

- Legal Advice

- Financial Advice

- Investment Advice

- Loan Origination Services

- Real Estate Broker

- Securities for Sale

Using MLOs For Dodd-Frank Compliance

In 2014 the Dodd-Frank Act was implemented under the guidance of the CFPB. While it provides exemptions for certain seller financing transactions, it is important to be sure that buyers planning to live in the property have the ability to repay.

A mortgage loan originator can help with qualifying the buyer and providing any related disclosures. Many MLOs work only with traditional mortgage loans, so it’s important to work with one experienced in seller financing. Fortunately, there are great options for these services with pricing around $500 and the cost can be passed on to the buyer.

Optimizing Mortgage Note Terms for Resale

The beauty of owner financing is the terms can be negotiated and agreed upon between the buyer and the seller. When selling the property and agreeing to “Be the Bank” you want to optimize the terms for potential resale to a note buyer for two reasons.

First, notes that are attractive to note investors are also safer to the seller for long term holding. Second, the note will be worth more should you want to sell all or part of the note to recapitalize. Even if you plan to hold the note long term, there is peace of mind knowing you have liquidity.

For lower risk and best pricing investors like to see the following for residential properties:

- Down Payment – 20% or more (10% Min.)

- Credit Rating – 680+

- Interest Rate – Fixed 9-10%

- Term – Fully Amortizing (20 to 30 years)

- Income – Ability to Repay (45%+/- Debt to Income Ratio)

- Reserves – Taxes & Insurance

- Servicing Through A Licensed Third Party

If a note doesn’t fit into this box it can usually still be bought and sold. The pricing will just be adjusted to compensate accordingly. Pricing on notes for resale can range from 95% to 50% (or less) of the balance due. That’s why it is so important to setup a note for success from the start.

10 Steps to Creating Owner Financed Notes

- Identify Your Team Members & Keep Them Involved

- Determine Sales Price and Initial Terms

- Market Property with Owner Financing

- Prequalify (Obtain Application, Authorization & Income)

- Negotiate Terms

- Put Offer and Acceptance in Writing (with Earnest Money)

- Underwrite, Credit Review & Qualify (with RMLO on owner occupied homes)

- Request Title & Complete Contingencies

- Setup Closing, Obtain Settlement Statement & Review Docs

- Closing, Recording & Servicing

Confidently Create Real Estate Notes!

Would you like to be a seller financing pro? Wondering how to best structure a note for resale? Want to confidently create, evaluate and own real estate notes?

We’ve put our 30+ years of experience into the Creating Notes Master Class. It provides in-depth coverage of all 10 steps along with advanced strategies for using wraps, partials, and note buyers for resale. Our goal is to help you to create notes safely, ethically, and profitably. Let us be your guide!

SPECIAL MASTER CLASS RELEASE SAVINGS! During this launch celebration you can save 25%!

Just use the coupon code ‘CREATE’ and you will immediately save 25% – just our way of saying thanks for the support!

About The Author

Welcome to the world of note investing! I’m Tracy Z and have been buying and selling real estate notes since 1988. I look forward to sharing my knowledge and helping you confidently create notes with owner financing.