Want to increase note investing yields? Discover ways to restructure a note for early payoff!

Want to increase note investing yields? Discover ways to restructure a note for early payoff!

When a real estate note pays off early an investor’s return can go up. Why? It is based on the Time Value of Money principal of…

“Money Now Is Worth More Than Money Later”

When notes are purchased at a discount (less than face value) the yield is already higher than the face rate of the note. When you combine that with an accelerated return the discount is earned back faster making the yield go up. But enough about theory, lets take a look at the numbers.

Note Investing Example: $50,000 at 8% interest with payments of $418.22

This example shows how to calculate the yield increase that comes from an early payoff on a discounted note. You can follow the example below or watch the video here.

(The video is one of the free previews in the How To Calculate Cash Flows Training with step by step instructions on how to use both TValue Amortization Software and an HP12C.)

Present Value (Loan) 50,000

Interest 8%

Term ???

Payment 418.22

Future Value –

| PV | I | PMT | N | FV |

| 50,000 | 8 | 418.22 | ??? | – |

Solve for N – The remaining term is 240 months.

Example: Invested $40,000 for 240 Note Payments. What Is The yield?

Present Value (Invest) 40,000

Interest (Yield) ???

Term 240

Payment 418.22

Future Value –

| PV | I | PMT | N | FV |

| 40,000 | ??? | 418.22 | 240 | – |

Solve for I – The anticipated yield is 11.20% (.933 x 12)

Example: The $50,000 Note Pays Off In 5 years. What is the Amount Due?

Present Value (Loan) 50,000

Interest 8%

Term 60

Payment 418.22

Future Value ???

| PV | I | PMT | N | FV |

| 50,000 | 8 | 418.22 | 60 | ??? |

Solve for FV – The future value/amount due after 60 payments is $43,762.79

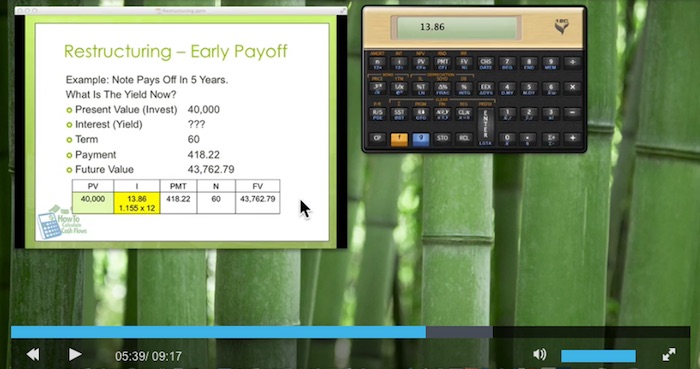

Example: Note Pays Off In 5 Years. What Is The Yield Now?

Present Value (Invest) 40,000

Interest (Yield) ???

Term 60

Payment 418.22

Future Value 43,762.79

| PV | I | PMT | N | FV |

| 40,000 | ??? | 418.22 | 60 | 43,762.79 |

Solve for I – The answer is 13.86% (1.155 x 12)

The note investment yield went from an anticipated 11.20% to 13.86% with an accelerated payoff. This works so well there are times it even makes sense to offer the note payer a discount to encourage an early repayment. Other strategies include Cutting The Rate/Doubling The Payment and Early Payoffs With Incentive.

Learning to restructure cash flows empowers you to:

- Increase Value By Speeding Up Repayment

- Make A Good Note Even Better

- Find Value Others Overlook

- Turn Non Performing to Performing

- Salvage A Note Gone Bad

Want more examples and step by step instructions? Access over 60 video lessons in the How To Calculate Cash Flows Online Training!

great notes, and reinforces the validity of the HP12C. Are you aware of any excel-based spreadsheets or templates which perform the same function?