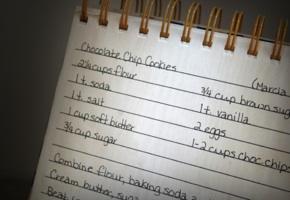

The stock market continues to retreat. Personal portfolios are dwindling. It is a “buyers market” in real estate. Banks, despite an unprecedented federal bailout, are tightening their lending programs so the average purchaser can’t obtain a loan. This is the recipe the private mortgage industry was founded on – and it has returned. … [Read more...] about Recipe for Success!

Note Buying Blog and Articles

Working with Private Investors

There is a squeeze on Wall Street that is leading many note buyers back to Main Street. The drought of institutional money from the sub prime mortgage crisis is creating a resurging interest in working with private investors for the purchase of seller-financed notes. … [Read more...] about Working with Private Investors

McCain and Obama Agree!

If you watched the last Presidential debate Wednesday night you probably noticed that Barack Obama and John McCain agreed on at least one thing. The economy is in the tank and it needs HELP! Now that we have found common ground for economists, Democrats, Republicans, and Independents alike, what can we do about it? And what does this have to do with seller financing? … [Read more...] about McCain and Obama Agree!

Real Deal #145 – Iowa Real Estate Contract

Welcome to Real Deals! It’s always easier to learn from real life so here we share information from actual owner financed transactions. While a note and mortgage or deed of trust are the most common real estate financing documents, sometimes seller financing utilizes a Real Estate Contract. The Terms - Real Estate Contract The seller agreed to accept owner financing on … [Read more...] about Real Deal #145 – Iowa Real Estate Contract

What the Federal Bailout Means to Seller Financing

Worried about the effect of toxic mortgages on the overall economy, the Federal government is pulling out the checkbook to help bailout failing mortgage companies. It started with Fannie Mae and Freddie Mac and now includes a proposal for another $700 billion infusion of funds. Why is the government involved and what does it mean for seller financing? … [Read more...] about What the Federal Bailout Means to Seller Financing

How Much House Can the Buyer Afford?

Many sellers accept owner financing without any idea of how much the buyer can actually afford to pay. The last thing a seller wants is to stress over receiving monthly payments or worse, getting the property back through foreclosure. Use these three simple methods to determine how much the buyer can afford before accepting seller financing. The amount a buyer can afford to … [Read more...] about How Much House Can the Buyer Afford?

Real Deal #144 – Mixed-Use in Oklahoma

Welcome to Real Estate Note Investing Real Deals! It’s always easier to learn from real life so here we share information from actual owner financed transactions. The creation of a note does not always follow a straight path. Often the terms are modified to fit the needs of the transaction. This note in Oklahoma started out as a sale of business, then included real estate, … [Read more...] about Real Deal #144 – Mixed-Use in Oklahoma

Finding Mortgage Notes with Reverse Ad Marketing

Many cash flow professionals are familiar with placing advertisements offering to purchase notes yet few take advantage of a technique we call Reverse Ad Marketing. This is one of our favorite note marketing methods based on the simplicity, effectiveness, and minimal cost. Essentially, potential clients are paying the marketing cost by placing their own ads offering property … [Read more...] about Finding Mortgage Notes with Reverse Ad Marketing

Avoid Three Costly Mistakes!

Would you rather have $97,000 to sell your $100,000 note or only $80,000? The difference usually comes down to the big three. Here’s the three biggest mistakes note sellers make and how to avoid flushing money down the drain. Seller Financing Mistake #1 - Failing to Check Credit The payer’s credit report lets you know how timely they have paid bills in the past. … [Read more...] about Avoid Three Costly Mistakes!

Real Deal #143 – New York Church Note

Welcome to Real Deals! It’s always easier to learn from real life so here we share information from actual owner financed transactions. Think it’s hard to get a home loan? Imagine the challenges that come with financing a church! Here’s how seller financing offered a creative solution to provide meeting space for a New York congregation. Note Terms - … [Read more...] about Real Deal #143 – New York Church Note